Apr 28, 2024

𝐶𝑢𝑟𝑟𝑒𝑛𝑐𝑦 𝑀𝑎𝑟𝑘𝑒𝑡.✨💸

*The Fundamentals*

What is Forex Trading ?

Forex trading can sound intimidating if it is the first time you are looking at a currency exchange chart. There is a lot of jargon involved that you need to understand before placing a trade. Nevertheless, the truth is that anybody can have access to trade currencies and make a profit.

So, what is forex trading? It’s the discipline of exchanging international currencies, which are traded against one another in pairs. Transactions take place in the forex (also known as foreign exchange or FX) market.

When you travel abroad and swap currency for local use, you’re already participating in the global forex market. But did you know that the foreign currency market trades a daily volume of more than $5.1 trillion? Maybe you are wondering what concepts you need to learn to trade FX like a pro. We’ve got your back! By the end of this guide, you will have a better understanding of the forex basics and the ability to read forex charts.

*Forex trading basics*

Let’s begin the introduction to forex by decoding the basics.

What is a forex pair?

In forex trading, prices are presented in currency pairs. One example is EUR/USD. The left currency (EUR or Euro) is known as the base currency, and the right currency (USD or US Dollars), the quoted currency. For example, a value of 1.0800 means that 1 Euro can be exchanged for 1.08 US Dollars.

There are different categories of forex pairs:

Major currency pairs

Majors are pairs that contain the USD on one side. They are the most liquid and frequently traded in the marketplace. These pairs include:

EUR/USD: Euro vs. US Dollar

USD/JPY: US Dollar vs. Japanese Yen

GBP/USD: British Pound vs. US Dollar

AUD/USD: Australian Dollar vs. US Dollar

USD/CHF: US Dollar vs. Swiss Franc

USD/CAD: US Dollar vs. Canadian Dollar

Cross-currency pairs

Crosses, or minors, are pairs that do not contain USD. The most active crosses known in the market involve the three different major currencies: EUR, JPY, and GBP.

Exotic currency pairs

Exotics are pairs made up of one major currency with another from an emerging market. Examples of emerging currencies include Brazil (BRL), Hong Kong (HKD), Singapore (SGD), and Mexico (MXN).

To keep things simple while getting started in forex, we suggest focusing your efforts on the majors and a couple of cross-currency pairs.

How to read forex charts

Now, let’s move on to deciphering graphic information. In trading, the market is represented visually through charts. A forex chart is simply one that depicts the exchange rate between two currencies over time.

There are three main types of charts:

Bar chart

Candle or Candlestick chart

Line chart

The Bar Chart

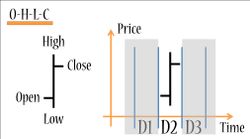

Shows: Highs, lows, opening, closing prices

How to read: A vertical line presents the high and low prices over the time period. A small horizontal dash on the left of the vertical line shows the opening price, while one on the right represents the closing price.

This chart is also known as OHLC, which refers to the four major price points in a time period — the example below shows one day in the example below. These levels are:

O – Open price

H – High price

L – Low price

C – Close price

*When is the forex market open ?*

Financial centers are comprised of banks, investment management firms, forex brokers, hedge funds, and investors. Therefore, forex pairs are traded 24 hours from Sunday 10:00 PM GMT to Friday at 10:00 PM GMT. The New York market starts trading right as the Australia market closes.

The 4 major sessions open in the below sequence:

Australia (Australia and New Zealand): from 10:00 PM GMT to 7:00 AM GMT

Tokyo (Asian markets): from 12:00 AM GMT to 9:00 AM GMT

London (European markets): from 8:00 AM GMT to 5:00 PM GMT

New York (Canada & USA): from 1:00 PM GMT to 10:00 PM GMT

This helps you get an idea of what type of schedule you can have when approaching a determined currency pair in the market. Most of the daily trading activity takes place between 1:00 PM and 5:00 PM when the London and New York sessions overlap.

By undefined

5 notes ・ 3 views

English

Proficient